UBL Voluntary Pension Fund - KPK

Pension ko Munafa Baksh banayen UBL Funds Kay Sath!

Why invest in UBL Voluntary Pension Fund - KPK?

Competitive Returns

Avail attractive Tax benefits

Free Life Insurance/ Takaful Coverage

Start investing with Rs. 1,000

Govt. of Khyber Pakhtunkhwa had amended the Khyber Pakhtunkhwa Civil Servants Act, 1973, in 2021 and the Pension structure has been changed for all new KP Govt. employees after the notification.

New employees who joined service on or after 7th June, 2022 will be part of the new Pension system introduced by KP Government.

UBL Voluntary Pension Fund – KPK aims to provide Employees with an individualized, funded (based on defined contribution) as well as flexible pension scheme which is managed by professional investment managers to assist them to plan and provide for their retirement. The design of the allocation scheme empowers the Employees to invest their pension savings as per their desired asset allocations

The scheme offers employees an easy and affordable means of growing their retirement savings in Money Market, Debt and Equity sub-funds, so that they can live a financially independent and rewarding life after retirement.

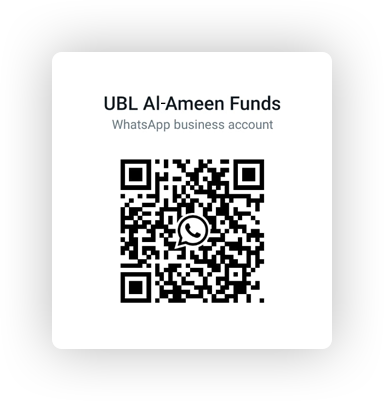

Contact our team for more details about our pension plans.

UBL Voluntary Pension Fund – KPK is ideal for investors who want:

- To save towards retirement with as low as Rs. 1000/- initial and subsequent contributions only.

- Govt. of KP as well as employees will both contribute a lump sum amount or invest periodically. Employee can optionally contribute more from his salary on his own.

- To invest in different asset classes to have a diversified portfolio*

- To avail tax credit on their investment.

- To transfer the balance from Conventional to Shariah compliant scheme or from Shariah compliant to Conventional with the same Pension/Asset Management Company or transfer any other Pension/Asset Management Company free of cost, any time under the VPS rules, 2005.

* During first three years, 100% allocation will be made in Money Market Sub-Funds only. After 3 years completion, employees may choose customized allocation.

Note: Any early withdrawal OR in excess of 20% withdrawal at OR after retirement will attract Withholding tax as per Income Tax Ordinance, 2001 (U/s 23A of Part 1 of The Second Schedule). Income from Income Payment Plans is also subject to income tax in the hands of Participant as per Income Tax Ordinance, 2001 w.e.f 1st July, 2022 as the exemption has been withdrawn through The Finance Act, 2022.

UBL Voluntary Pension Fund – KPK

Need more information about the fund? Here’s what you need to know.

Explore More Register Here Contact

Fund Information

Medium

Invest Now

Investing has never been easier. Fill in your details, build your optimal portfolio, and start your investment journey today

Fund Documents

Register Now for UBL Voluntary Pension Fund - KPK

Get In Touch

Not registered to UBL Funds Online?

sms ONLINE to 8258

Forgot your username or password?

call 0800-00026